In recent times, cryptocurrencies have gained tremendous attention and popularity. The cryptocurrency Bitcoin made its debut in 2009, and since then, thousands of other digital currencies have emerged. One crucial aspect of cryptocurrencies is mining, which plays a role in their creation and security. But what exactly is involved in cryptocurrency mining? Let’s dive into the details of this procedure.

What is Cryptocurrency Mining?

Cryptocurrency mining refers to the process of verifying and adding new transactions to a blockchain – the underlying technology that powers cryptocurrencies. Miners utilize computers to solve complex mathematical problems, ensuring that transactions are genuine and valid. As a reward for solving these problems, miners receive an amount of cryptocurrency. In addition to that, dual asset mining introduces a dynamic element to the traditional cryptocurrency mining landscape, enabling miners to adapt to market trends and capitalize on the most lucrative digital assets available.

The Significance of Cryptocurrency Mining

Mining serves two purposes within the realm of cryptocurrencies. Firstly, it helps maintain the integrity of the blockchain by preventing activities like unregulated spending. Secondly, it plays a role in introducing units of cryptocurrency into circulation. For more detailed information and guidance on cryptocurrency mining, you can check out Invest Diva’s price and programs.

How Does Cryptocurrency Mining Operate?

To comprehend how cryptocurrency mining functions, it’s essential to grasp the basics behind blockchain technology. A blockchain serves as a distributed ledger that transparently records all transactions in an organized manner. In the case of Bitcoin, for instance, the blockchain is made up of a series of blocks. Each block contains a set of transactions that have been verified.

Whenever a transaction takes place, it is shared with a network of computers or nodes that participate in the mining process. These nodes gather the transaction and include it in a pool called the memory pool or mempool, where unverified transactions are stored. Miners using hardware setups known as mining rigs compete to solve a mathematical puzzle that demands significant computational power. This puzzle is called a proof of work (PoW) algorithm. For Bitcoin specifically, it is referred to as the SHA 256 algorithm, while other cryptocurrencies may employ other algorithms.

The objective for miners is to find a number known as nonce. When combined with data from the block, this nonce should produce a hash value that meets specific requirements. Miners repeat this process until they successfully discover a nonce. The miner who solves the puzzle first broadcasts both the nonce and its corresponding block to the rest of the network. Once other nodes in the network verify and confirm the block’s validity, it becomes part of the blockchain. Consequently, all transactions within that block are considered confirmed. Miners are rewarded for their work in cryptocurrency mining through a number of newly created cryptocurrency units and any transaction fees associated with the transactions included in the block they successfully mine.

Challenges Faced in Cryptocurrency Mining

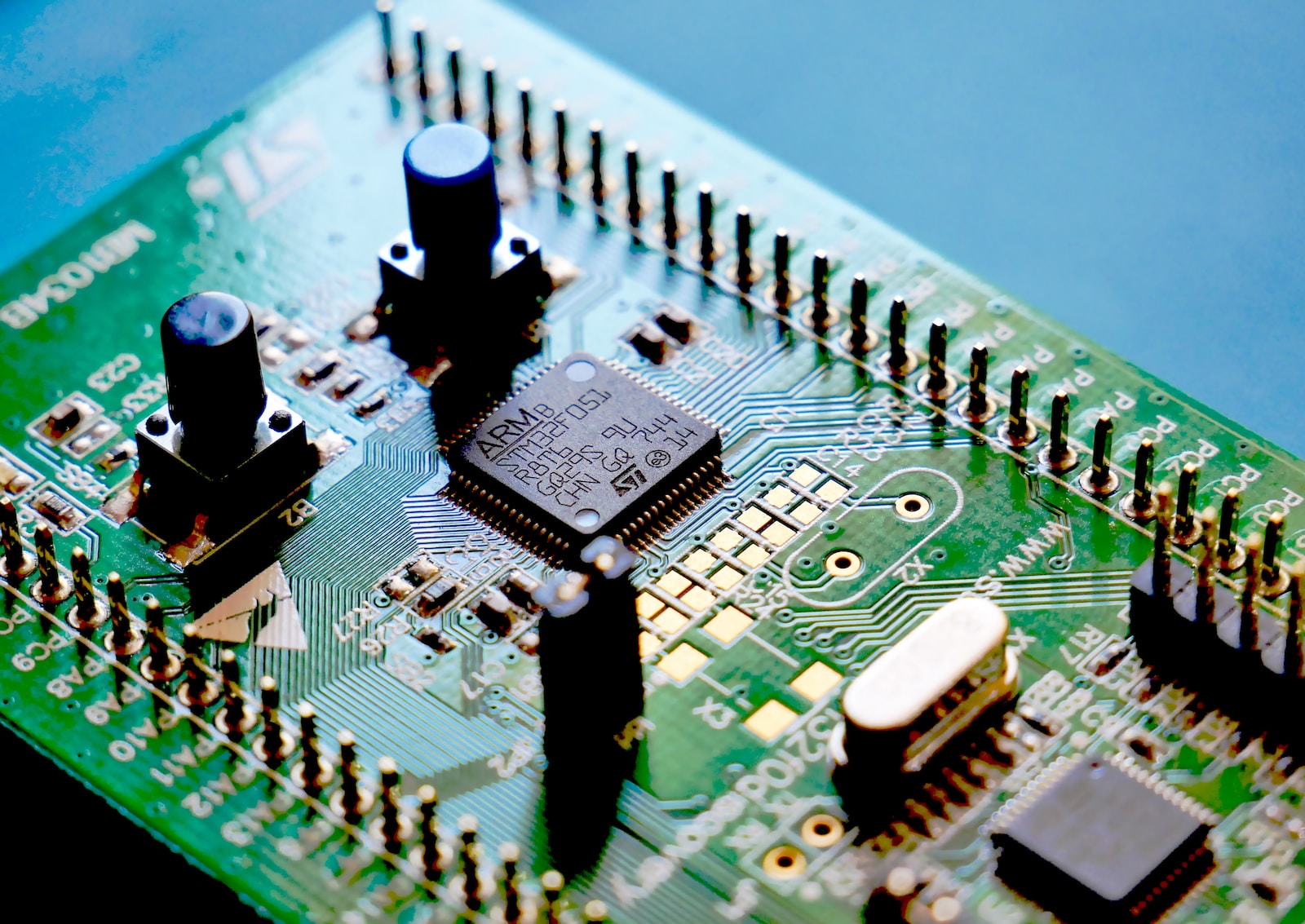

Cryptocurrency mining poses challenges for miners on a daily basis. Firstly, it requires considerable computing power and consumes a substantial amount of electricity. Miners utilize computers known as mining rigs equipped with GPUs or ASICs (Application Specific Integrated Circuits), which are specifically designed for mining cryptocurrencies. These rigs consume a vast amount of electricity, resulting in high operational costs.

Moreover, mining has become increasingly competitive over time. The growing popularity of cryptocurrencies has attracted individuals and organizations to join the mining community, making it harder to mine blocks successfully. To stay competitive, miners now rely on mining hardware.

Additionally, the block reward – the amount of cryptocurrency given to miners who successfully mine a block – decreases over time. In the case of Bitcoin, this reward is halved every four years. As a result, miners must mine several blocks to maintain their profitability at the same level.

Given the changes that the crypto market undergoes every year, cryptocurrency mining comes with its fair share of challenges and risks. However, for the price of Invest Diva’s course, methods of creating an income are possible. By understanding how cryptocurrency mining works, investing in a good mining rig, and evaluating all the currencies available to find the most profitable one to mine, you can still ensure a decent return on your investment.